Stamp Law of the People's Republic of China

Release Time:

2022-06-02

The new version of the Stamp Duty Law of the People's Republic of China will reduce the stamp duty of "trademark exclusive right, copyright, patent right and proprietary technology right transfer document" from the stamp duty provisional regulations of the amount contained in the 50 thousand to 3 thousand, in order to implement tax reduction and fee reduction, support innovation and development, and encourage the implementation of intellectual property application.

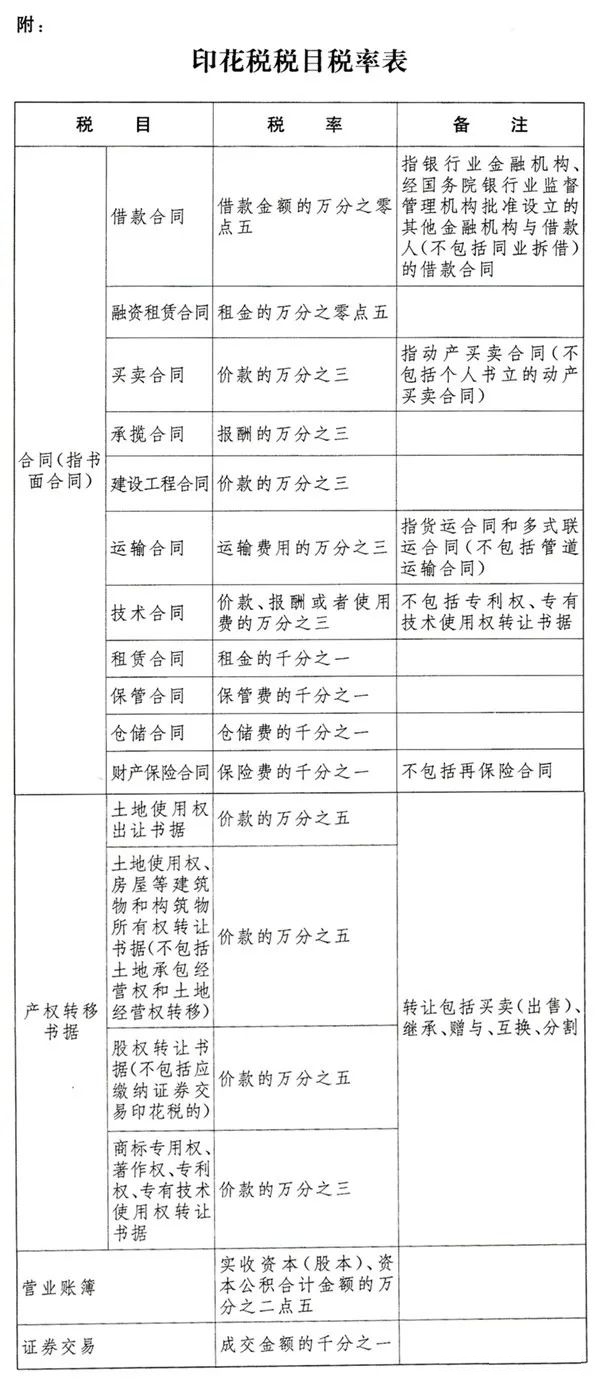

The new version of the Stamp Duty Law of the People's Republic of China will reduce the stamp duty of "trademark exclusive right, copyright, patent right and proprietary technology right transfer document" from the stamp duty provisional regulations of the amount contained in the 50 thousand to 3 thousand, in order to implement tax reduction and fee reduction, support innovation and development, and encourage the implementation of intellectual property application.

The transfer under the Stamp Act includes sale (sale), inheritance, gift, exchange and division. In addition, the trademark registration certificate and patent certificate provided for by the provisional Stamp Duty Regulations are abolished in the stamp Tax Law passed this time.

Stamp Tax Law of the People's Republic of China

(Adopted at the 29th Meeting of the Standing Committee of the 13th National People's Congress on June 10, 2021)

Article 1 Units and individuals that issue taxable certificates in writing or conduct securities transactions within the territory of the People's Republic of China shall be taxpayers of stamp duty and shall pay stamp duty in accordance with the provisions of this Law.

Units and individuals outside the territory of the People's Republic of China writing taxable certificates for use within the territory shall pay stamp duty in accordance with the provisions of this Law.

Article 2 The term "taxable documents" as used in this Law refers to the contracts, property rights transfer documents and business books listed in the Table of Stamp Duty Items and Rates attached to this Law.

Article 3 The term "securities trading" as used in this Law refers to the transfer of stocks and stock-based depositary receipts traded at the stock exchanges established according to law and other national securities trading venues approved by The State Council.

Stamp tax on securities transactions is levied on the transferor of securities transactions, but not on the transferee.

Article 4 The tax items and tax rates of stamp duty shall be implemented in accordance with the Table of Tax Items and Tax Rates of Stamp Duty attached to this Law.

Article 5 The basis for tax calculation of stamp duty is as follows:

(1) The taxable basis of a taxable contract shall be the amount specified in the contract, excluding the specified value-added tax;

(2) The tax basis for the taxable property right transfer document shall be the amount listed in the property right transfer document, excluding the specified value-added tax;

(3) The tax basis for the taxable business books shall be the total amount of paid-in capital (share capital) and capital reserve recorded in the books;

(4) The tax basis for securities transactions shall be the transaction amount.

Article 6 Where the amount of the taxable contract or the transfer of property rights is not specified, the tax calculation basis of the stamp duty shall be determined according to the actual settlement amount.

If the basis for tax calculation cannot be determined in accordance with the provisions of the preceding paragraph, it shall be determined in accordance with the market price at the time of the written contract or the document of transfer of property rights; Where prices set by the government or guided by the government should be implemented according to law, they shall be determined in accordance with the relevant provisions of the State.

Article 7 Where there is no transfer price in a stock transaction, the tax basis shall be determined according to the closing price of the stock on the previous trading day at the time of registration of transfer. If there is no closing price, the tax basis shall be determined according to the par value of the securities.

Article 8 The tax payable on stamp duty shall be calculated on the basis of tax calculation multiplied by the applicable tax rate.

Article 9 Where the same taxable certificate contains two or more tax items and specifies the amount of tax separately, the tax payable shall be calculated separately according to the tax rates of the respective tax items. Where the respective amounts are not specified, the higher tax rate shall apply.

Article 10 Where the same taxable document is written by two or more parties, the amount of tax payable shall be calculated separately according to the amounts involved respectively.

Article 11 Where the total amount of paid-in capital (share capital) and capital reserve recorded in the business books for which stamp duty has been paid increases over the total amount of paid-in capital (share capital) and capital reserve for subsequent years, the amount of tax payable shall be calculated on the basis of the increase.

Article 12 The following certificates are exempt from stamp duty:

(1) copies or copies of taxable certificates;

(2) Foreign embassies, consulates and representative offices of international organizations in China, which should be exempt from tax in accordance with the law, shall obtain taxable certificates on their premises;

(3) written taxable vouchers of the Chinese People's Liberation Army and the Chinese People's Armed Police Forces;

(4) Sales contracts and agricultural insurance contracts signed by farmers, family farms, farmers' specialized cooperatives, rural collective economic organizations and villagers' committees for purchasing means of agricultural production or selling agricultural products;

(5) interest-free or discount loan contracts, loan contracts in which international financial organizations provide preferential loans to China;

(6) Written documents of transfer of property rights in which the property owner has donated the property to the government, school, social welfare institution or charitable organization;

(7) Written sales contracts for the purchase of drugs or health materials by non-profit medical and health institutions;

(8) Electronic orders entered into by individuals and e-commerce operators.

In accordance with the needs of the national economic and social development, The State Council may provide for the reduction or exemption of stamp duty in respect of the security of residents' housing needs, restructuring and reorganization of enterprises, bankruptcy, support for the development of small and micro enterprises, and report it to the Standing Committee of the National People's Congress for the record.

Article 13 Where a taxpayer is a unit, it shall declare and pay stamp duty to the competent tax authorities where its establishment is located. A taxpayer who is an individual shall declare and pay stamp duty to the competent tax authority at the place where the taxable certificate is written or where the taxpayer resides.

Where the property right of immovable property is transferred, the taxpayer shall declare and pay stamp duty to the competent tax authority where the immovable property is located.

Article 14 Where a taxpayer is an overseas entity or individual and has an agent in China, its domestic agent shall be the withholding agent; If there is no agent in the territory, the taxpayer shall declare and pay the stamp duty on his own, and the specific measures shall be formulated by the competent tax department under The State Council.

A securities registration and settlement institution is a withholding agent for the stamp tax of securities transactions, and shall report the tax paid and the interest on bank settlement to the competent tax authority where its institution is located.

Article 15 The tax obligation of stamp duty shall occur on the day on which the taxpayer places the taxable certificate or completes the securities transaction.

The time when the duty of withholding stamp tax on securities transactions occurs is the day when the securities transactions are completed.

Article 16 Stamp duty shall be levied on a quarterly, annual or periodical basis. Where tax is levied on a quarterly or annual basis, the taxpayer shall declare and pay the tax within 15 days from the end of the quarter or year. Where tax is levied on a case-by-case basis, the taxpayer shall declare and pay the tax within 15 days from the date of occurrence of the tax obligation.

Stamp duty on securities transactions is paid weekly. The withholding agent for stamp duty on securities transactions shall declare the tax paid and the interest on bank settlement within five days from the end of each week.

Article 17 Stamp duty may be paid by pasting stamp duty or by issuing other tax payment certificates by the tax authorities according to law.

Where the stamp duty stamp is affixed to the taxable certificate, the taxpayer shall stamp or draw off the stamp at the slot of each tax stamp.

The stamp duty shall be produced under the supervision of the competent tax department under The State Council.

Article 18 Stamp duty shall be collected and administered by the tax authorities in accordance with this Law and the Law of the People's Republic of China on the Administration of Tax Collection.

Article 19 Taxpayers, withholding agents, tax authorities and their staff who violate the provisions of this Law shall be investigated for legal responsibility in accordance with the Law of the People's Republic of China on the Administration of Tax Collection and other relevant laws and administrative regulations.

Article 20 This Law shall come into force as of July 1, 2022. The Provisional Regulations of the People's Republic of China on Stamp Duty promulgated by The State Council on August 6, 1988 shall be repealed simultaneously.

▌Source: China Patent Electronic Application Network, Chinese people's network

Relevant Content

Telephone:

Telephone:+86-755-82566227、82566717、13751089600

Head Office:13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Head Office:

13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Subsidiary Company:2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Subsidiary Company:

2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Service Number

Subscription Number

Copyright ©2016 Shenzhen Shenkexin patent Agency Co., LTD All rights reserved | 粤ICP备2021174526号

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有 | 粤ICP备2021174526号 SEO标签

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有