News Updates

NEWS CENTER

Related News

There is currently no data available

Schindler Industrial IPO: The core product sales rate continues to decline before the listing of patent "support front"

Release Time:

2022-09-23

With the continuous development of the automobile industry, the trend of independent and specialized development of auto parts enterprises is becoming more and more obvious. Recently, Zhejiang Schindler Industrial Technology Co., LTD. (hereinafter referred to as "Schindler Industries") submitted a prospectus to be listed on the GEM. In the first half of 2022, affected by the epidemic in some parts of the country, the domestic automotive industry suffered a short-term impact, and in the face of the downstream "cooling" situation, Schindler's industrial performance as an automotive transmission system parts manufacturer was difficult to hide the decline in the dilemma.

"Nearly half of R&D technicians have low education levels."

*The views expressed here are those of the author and do not represent the position of the company

With the continuous development of the automobile industry, the trend of independent and specialized development of auto parts enterprises is becoming more and more obvious. Recently, Zhejiang Schindler Industrial Technology Co., LTD. (hereinafter referred to as "Schindler Industries") submitted a prospectus to be listed on the GEM.

In the first half of 2022, affected by the epidemic in some parts of the country, the domestic automotive industry suffered a short-term impact, and in the face of the downstream "cooling" situation, Schindler's industrial performance as an automotive transmission system parts manufacturer was difficult to hide the decline in the dilemma. During the reporting period of 2019-2021 and the first half of 2022, the production and sales rate of the company's core product synchronizer declined year by year, resulting in an increase in the inventory scale. At the same time, the collection method of credit sales makes the company's accounts receivable high, and the collection cycle is prolonged.

It is worth noting that although it has both high-tech enterprises and "specialized and new" enterprises, Schindler Industry is difficult to compete with companies in the same industry in terms of research and innovation, and there is a suspicion of "surprise" patent application on the eve of listing. In addition, nearly half of the research and development personnel of Schindler Industries have college degrees or below, and only one of the core technical personnel has obtained a bachelor's degree, and the technical research and development team has a low degree.

Raise English signboards"

The rate of production and sales of core products fell

According to public information, Schindler Industrial is mainly engaged in the research and development, production and sales of automotive transmission system parts, and its core products are synchronizer assembly, gear hub, gear sleeve and other products. The company's downstream customers are mainly SAIC transmission, Tsingshan Industrial, Shandong Monwo and other well-known domestic automobile transmission manufacturers, and the products are eventually applied to Changan Automobile, Dongfeng Automobile and many other brands in the low-end models.

Although holding the "thigh" of well-known car companies, affected by the decline in domestic passenger vehicle sales and weakening downstream demand, during the reporting period, Schindler Industrial fell into the dilemma of stagnant revenue growth and declining net profit. In the first half of 2019-2022, Schindler's industrial operating income was 230 million yuan, 228 million yuan, 243 million yuan and 95.1378 million yuan, respectively, and the net profit attributable to the mother in the same period was 42.6529 million yuan, 54.5440 million yuan, 53.729,900 yuan and 21.1521 million yuan, respectively.

In the first half of 2022, affected by the epidemic in some parts of the country, the automobile industry suffered a short-term impact, and the car sales in the current period were 12.0570 million, down 6.47% from the same period last year. In addition, superimposed on the impact of new energy models, the sales of domestic low-end models, especially low-end fuel models, also declined compared with the same period last year.

According to Sohu Auto data, the Wuling Hongguang series of cars using Schindler Industrial's "SC16M5 synchronizer" had a cumulative sales volume of 83,500 units from January to August 2022, down 33.26% from 125,200 units in the same period in 2021. The cumulative sales volume of Changan Escape series cars using Schindler Industrial's DF727 synchronizer from January to August 2022 was 98,800 units, down 13.54% from 114,500 units in the same period in 2021.

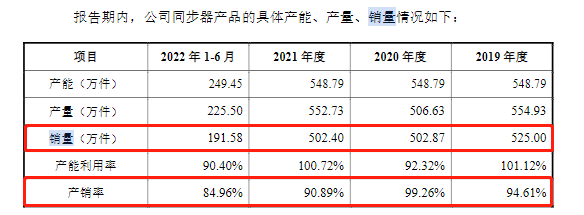

The decline in sales of terminal models has also affected the production and sales of industrial synchronizer products of upstream supplier Schindler. Sales of Schindler's industrial synchronizer products fell by 4.22% in 2020, and the data in 2021 was basically flat, while in the first half of 2022, the company's synchronizer product sales declined, less than half of the previous three years.

Photo source: Schindler Industrial prospectus

At the same time, the production and sales rate of Schindler industrial synchronizer products has decreased significantly. In 2020, the production and sales rate of the product reached 99.26%, in 2021, its production and sales rate dropped to 90.89%, and in January-June 2022, it further dropped to 84.96%.

Accounts receivable, inventory double high cash flow pressure

The declining production and sales rate has also led to increased inventory pressure.

At the end of each reporting period, the book value of the company's inventory was 52,202 yuan, 51,053 yuan, 72,0319 yuan and 91,163,300 yuan, accounting for 17.49%, 17.79%, 24.21% and 32.44% of current assets, respectively. The larger inventory brings the risk of inventory decline for the company, and the corresponding amount of reserve for inventory decline in the same period is 4,697,500 yuan, 5,250,300 yuan, 5,258,900 yuan and 5,903,600 yuan, respectively.

In addition, compared with comparable companies in the industry, Schindler Industrial's inventory turnover rate is on the low side. From 2019 to 2021, the company's inventory turnover rate was 2.44 times, 2.56 times and 2.26 times, respectively, while the average inventory turnover rate of comparable companies in the same industry was 3.47 times, 3.41 times and 3.27 times, respectively.

While the inventory is overstocked, Schindler Industries' accounts receivable are also increasing year by year. According to the prospectus, Schindler Industries mainly adopts credit sales to customers. At the end of the reporting period, the total book value of accounts receivable and notes receivable of Schindler Industries is 217 million yuan, 199 million yuan, 172 million yuan and 132 million yuan, respectively. The proportion of current assets were 72.74%, 69.22%, 57.75% and 46.99%, respectively. Despite the decline in the amount and proportion of receivables, Schindler Industries' receivables and notes far exceeded its revenue in the first half of 2022.

In each reporting period, Schindler's industrial receivables turnover rate was also lower than the industry average, which was 2.25 times, 2.16 times, 2.48 times and 1.25 times, respectively, and the industry average level from 2019 to 2021 was 3.64 times, 3.59 times and 3.95 times.

The payback cycle is relatively long, resulting in a certain pressure on the company's cash flow. During the reporting period, Schindler's industrial operating cash flow was -9.1996 million yuan, 54.4041 million yuan, 49.333 million yuan and 10.6926 million yuan, respectively.

Although China's automobile industry has entered a relatively stable stage of development, if the future automobile consumption downturn, coupled with the core product declining production and sales rate, surging inventory and high receivables, or will bury an indefinite time "bomb" for the future operation of Schindler Industrial.

Nearly half of the R&D technicians who applied for patents on the eve of listing had low academic qualifications

According to the prospectus, Schindler Industries said that in the process of business development, it has always attached importance to technology development and accumulation, forming a rich technical reserve, and a number of technical achievements that can be widely used in auto parts products. In addition, the company has high-tech enterprise identification and "specialized and special new" enterprise identification.

However, in terms of innovative research and development, Schindler's number of industrial patents and R&D expense rate are not comparable to other companies in the industry.

Schindler Industries said that as of the signing date of the prospectus, the company has obtained 9 invention patents and 16 utility model patents. It is worth noting that eight of the invention patents were applied for by Schindler Industries in 2020 and 2021, and seven were authorized in 2022.

Compared with comparable companies in the industry, Schindler Industries is slightly inferior in the number of patents. As of the end of June 2022, the comparable company in the same industry has 157 patents; Precision Forging Technology has 194 patents, including 44 invention patents; Mingyang Technology has 38 patents, including 4 invention patents.

In addition, in terms of R&D investment, in each period of the reporting period, Schindler Industrial invested R&D expenses of 10.708 million yuan, 10.75577 million yuan, 11.7141 million yuan and 5.7676 million yuan respectively. From the perspective of the project composition, nearly half of the research and development costs were spent on employee salaries, which were 4,864,100 yuan, 5,025,100 yuan, 5,753,800 yuan and 2,751,900 yuan, respectively. It is worth noting that the research and development technicians of Schindler Industries have low education. According to the prospectus, as of June 2022, Schindler Industrial has a total of 358 employees and 36 research and development personnel, accounting for 10.06% of the total number of employees of the company, including 4 core technical personnel.

The educational structure of the company's employees is above 21 people, 36 people are college students, and 301 people are high school students. In other words, nearly half of the 36 R & D personnel of Schindler Industry are college degrees or below, while only Chen Chunxian of the four core technical personnel has obtained a bachelor's degree, Wang Hongyu and Zhong Yonghuo are college degrees, and Liu Zhongyun is a secondary school degree.

For Schindler Industrial IPO progress, China net finance will continue to pay attention. (Source: China.org.cn Financial Author: Ye Shallow Shan Shengqun)

More intellectual property information and services

Pay attention to [Shenkexin Intellectual Property] Official subscription number

More deeply credible dynamic news, important data/report/case, etc.

Pay attention to the [Shenkexin Intellectual Property Service Platform] official service number

相关新闻

Telephone:

Telephone:+86-755-82566227、82566717、13751089600

Head Office:13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Head Office:

13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Subsidiary Company:2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Subsidiary Company:

2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Service Number

Subscription Number

Copyright ©2016 Shenzhen Shenkexin patent Agency Co., LTD All rights reserved | 粤ICP备2021174526号

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有 | 粤ICP备2021174526号 SEO标签

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有