News Updates

NEWS CENTER

Related News

There is currently no data available

The appraised value of 9 utility model patents exceeded 150 million yuan, and the loan was 35 million yuan

Release Time:

2022-06-07

Recently, Guangzhou Gaolan Energy Saving Technology Co., LTD. (hereinafter referred to as "Gaolan Shares") issued an announcement on pledging loans with its own patent rights, which has attracted a lot of attention in the industry. In the announcement, Gao LAN said that in order to meet the company's working capital needs and reduce financing costs, the company will use its own patent rights to pledge to the Bank of China Limited Guangzhou Zhujiang Branch for 35 million yuan loan, the loan term is not more than one year (including).

Recently, Guangzhou Gaolan Energy Saving Technology Co., LTD. (hereinafter referred to as "Gaolan Shares") issued an announcement on pledging loans with its own patent rights, which has attracted a lot of attention in the industry. In the announcement, Gao LAN said that in order to meet the company's working capital needs and reduce financing costs, the company will use its own patent rights to pledge to the Bank of China Limited Guangzhou Zhujiang Branch for 35 million yuan loan, the loan term is not more than one year (including).

The appraised value of the nine utility model patents was 153 million yuan

According to the official website of the Shenzhen Stock Exchange information disclosure, on May 20, Gaolan shares issued this announcement.

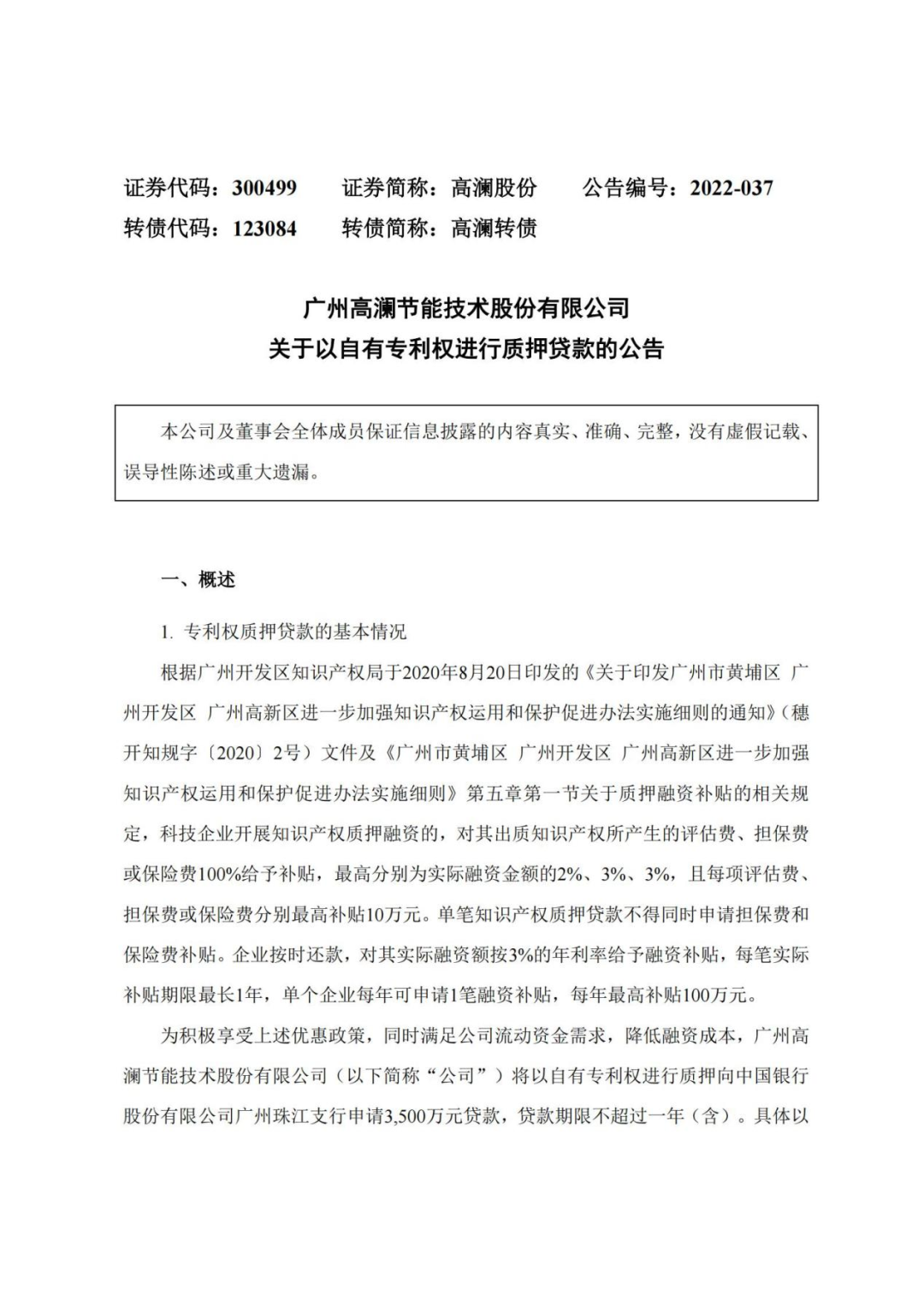

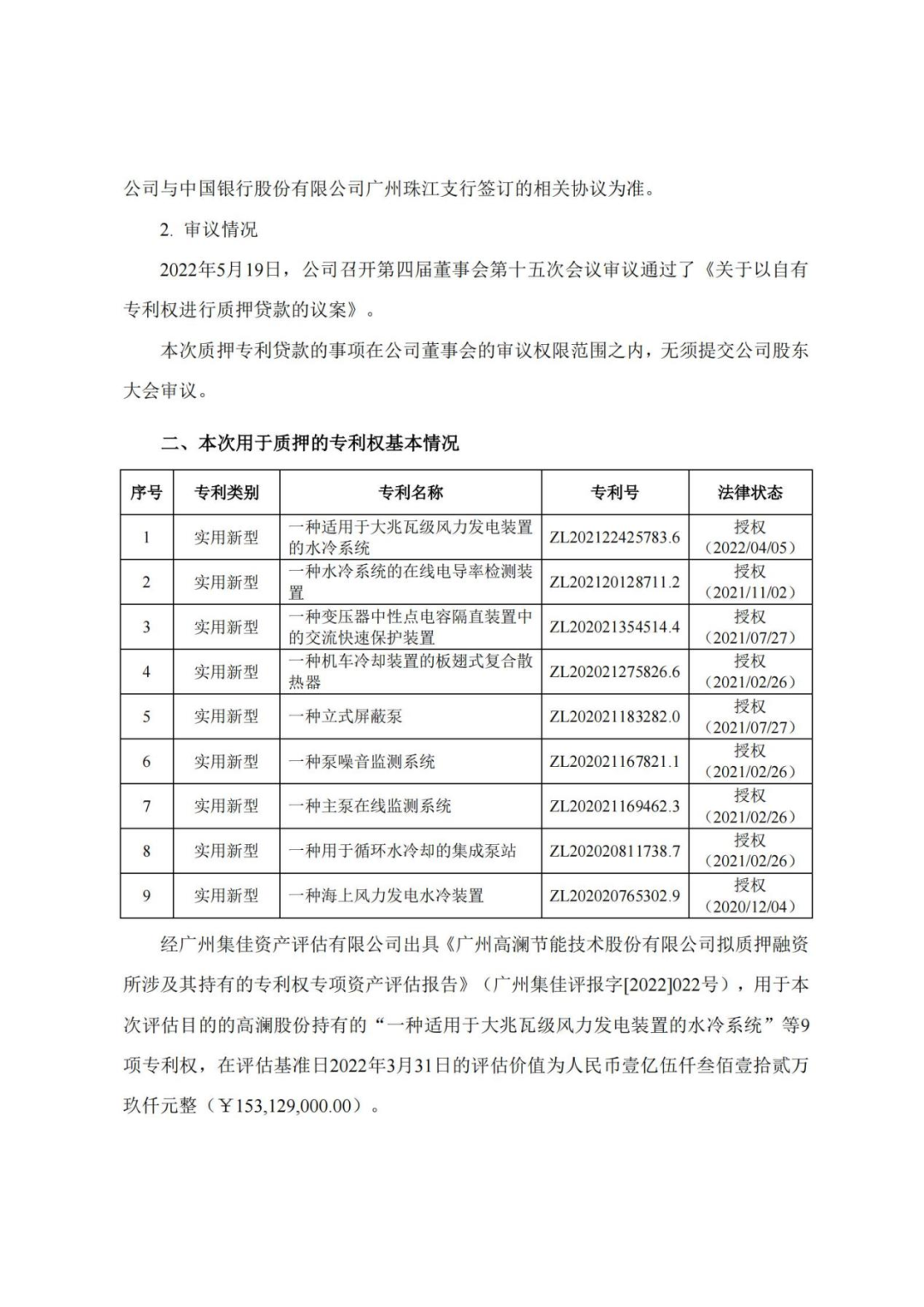

As disclosed in the announcement, the basic situation of the patent rights used for pledge is as follows:

Guangzhou Jijia Asset Evaluation Co., Ltd. issued the "Guangzhou Gaolan Energy Saving Technology Co., Ltd. to pledge financing involved in its patent special Asset evaluation report" (Guangzhou Jijia commentary word [2022]022), for the purpose of this evaluation held by Gaolan Stock "a water cooling system suitable for large megawatt wind power plant" and other 9 patents, The assessed value as of March 31, 2022, the base date of appraisal, is RMB one hundred and thirty-one hundred and twenty-nine thousand Yuan (¥153,129,000.00).

Pledged loans to actively enjoy preferential policies

The announcement said, According to the "Notice on Printing and Distributing the Implementation Rules of the Measures for Further Strengthening the Application and Protection of Intellectual Property Rights in Guangzhou High-tech Zone, Guangzhou Development Zone, Huangpu District, Guangzhou" issued by the Intellectual Property Office of Guangzhou Development Zone on August 20, 2020 (SuiKaizhigui Zi (2020) 2) and the "Guangzhou Development Zone, Huangpu District, Guangzhou" Guangzhou High-Tech Zone to further strengthen the implementation of Measures to promote the use and protection of Intellectual property rights, Chapter 5, Section 1 on the relevant provisions of the pledge financing subsidies, science and technology enterprises to carry out intellectual property pledge financing, the evaluation fee, guarantee premium or insurance premium generated by its pledged intellectual property 100% subsidies, the highest is 2%, 3%, 3% of the actual financing amount. And the maximum subsidy of each assessment fee, guarantee premium or insurance premium is 100,000 yuan. A single intellectual property pledge loan may not apply for guarantee premium and insurance premium subsidy at the same time. Enterprises repay on time, the actual amount of financing at 3% annual interest rate to give financing subsidies, each actual subsidy period of up to 1 year, a single enterprise can apply for one financing subsidy per year, the maximum subsidy of 1 million yuan per year.

The choice of Gaolan shares to pledge patent loans is also mentioned in the announcement to actively enjoy the above preferential policies, while meeting the company's working capital needs and reducing financing costs.

Regarding the impact of pledging patents on the company, the announcement said that the use of preferential policies to pledge loans will help further broaden the company's financing channels, optimize the financing structure, reduce financing costs, and effectively meet the company's capital needs and business development needs. This patent pledge will not affect the normal use of the company's relevant patent rights, will not have a significant impact on the company's production and operation and financial status, and will not harm the interests of the company and all shareholders.

In addition, according to the information disclosure of the Shenzhen Stock Exchange, on the same day, Gaolan shares also issued an announcement on the holding subsidiary's investment in the construction of power battery thermal management and automotive electronics manufacturing headquarters project. The announcement shows that the company's holding subsidiary Dongguan Sixiang intends to sign the "Dongguan Sixiang Power battery thermal management and automotive electronics Manufacturing Headquarters Project Investment Agreement" with the people's government of Dongguan Wangniudun Town, to invest 700 million yuan in the construction of power battery thermal management and automotive electronics manufacturing headquarters project.

According to the research of "Electric Eel Finance", the net cash flow generated by operating activities, the net cash flow generated by investment activities and the net cash flow generated by financing activities in the company's cash flow statement in the first quarter of this year are all net outflows. In addition, the latest financial report of Gaolan shares shows that the company's cash and cash equivalents balance at the end of the period is only about 136 million yuan. [1]

It can be inferred that meeting the company's working capital needs is also one of the main reasons for the patent pledge.

There is still room for development of intellectual property pledge financing

In recent years, many small and medium-sized enterprises have been under great pressure of economic development, and the intellectual property pledge financing has brought the source of vitality at this time.

According to the data disclosed by the State Intellectual Property Office in January this year, the scale of China's patent and trademark pledge financing has been further expanded in recent years, and the universality has been further highlighted. In 2021, the national patent and trademark pledge financing amount reached 309.8 billion yuan, 17,000 financing projects, benefiting 15,000 enterprises, an increase of about 42%. Among them, the inclusive loans of less than 10 million yuan benefited 11,000 enterprises, accounting for 71.8% of the total number of beneficial enterprises, which fully shows the inclusive characteristics of intellectual property pledge financing services for small and medium-sized enterprises.

Under the impact of the new round of epidemic this year, intellectual property management departments in many places across the country have introduced rescue policies to help enterprises, most of which include assistance in intellectual property pledge financing, and actively support and help enterprises tide over difficulties and resume development.

However, there are still many "blocking points" in intellectual property pledge financing. According to the China Economic Weekly, there are three difficulties in the disposal of intellectual property, risk control and evaluation, which lead to the problem of direct pledge of intellectual property. In particular, the price changes of patents are also large, and many patents are invalid every year, or there are infringement, technology upgrading and other problems, which will also affect the value of patents, and the risk is difficult to control. The most important issue is the evaluation, due to a variety of evaluation methods, the credit discount for intellectual property is generally large, take invention patents as an example, in most cases only 30% of the assessed value of the credit line, and some only 15%. [2]

How to get through these blocked points, so that intellectual property can really solve the "urgent needs" of enterprises, still need to be jointly promoted by relevant management departments and enterprises.

Attached: The original announcement of Gaolan Shares on pledging loans with its own patent rights

Notes:

【 1 】. Korea. The acquisition of dongguan si xiang buried goodwill Gao Lan shares overweight battery thermal management funding gap is very large. http://www.dmkb.net/html/2022/05/147849.html

[2]. Shi Qingchuan, Guo Zhiqiang. Patent change dividend, "knowledge production" "asset" intellectual property pledge financing difficult problem. http://www.ceweekly.cn/2022/0516/383833.shtml

More intellectual property information and services

Pay attention to [Shenkexin Intellectual Property] Official subscription number

More deeply credible dynamic news, important data/report/case, etc.

Pay attention to the [Shenkexin Intellectual Property Service Platform] official service number

相关新闻

Telephone:

Telephone:+86-755-82566227、82566717、13751089600

Head Office:13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Head Office:

13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Subsidiary Company:2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Subsidiary Company:

2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Service Number

Subscription Number

Copyright ©2016 Shenzhen Shenkexin patent Agency Co., LTD All rights reserved | 粤ICP备2021174526号

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有 | 粤ICP备2021174526号 SEO标签

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有