News Updates

NEWS CENTER

Related News

There is currently no data available

How to evaluate patents? How can patents be priced more reasonably?

Release Time:

2022-09-08

Generally speaking, patent evaluation is divided into two categories: one is to use asset evaluation methods, such as cost method, market method, income method, etc., based on the market mechanism to determine the estimated patent price, which is the specific amount; One is the use of patent value analysis evaluation index system, usually from the legal, technical, economic and other dimensions, the patent value obtained by comprehensive evaluation, or patent value degree, non-price amount. As we all know, patent, as a kind of intellectual property intangible assets, has asset attributes. At the same time, patent as technical text, legal text also has technical attributes, legal attributes and so on. Therefore, scientific evaluation methods and evaluation indicators should be adopted to comprehensively consider various attributes in patent evaluation. In addition, based on different purposes and application scenarios, the selection of patent evaluation methods and indicators should also be focused, so that the assessed and estimated value of patent assets can be more consistent with the actual situation, and can be more fair to promote cooperation between the two parties.

The "Guidance Opinions on Patent Assets Evaluation" issued and implemented on October 1, 2017 also pointed out that the implementation of patent assets evaluation business should pay attention to the legal factors, technical factors, economic factors that affect the value of patent assets. However, at present, the evaluation of patent price and patent value in the market has not been fully integrated, how to comprehensively measure the external attributes and internal characteristics of patents, and how to better combine the evaluation index system of patent value analysis with the asset evaluation method is still a difficult problem in the industry.

It is gratifying to note that the State Intellectual Property Office, based on its work practices such as guiding and standardizing intellectual property asset evaluation, carrying out pilot patent value analysis, and systematically summarizing and sorting out the basic characteristics, index system, application scenarios, and practical operation methods of patent value evaluation, organized and drafted the recommended standards for Patent Evaluation Guidelines in 2021. At present, the draft of the guidelines has been released, in the hope that after the formal introduction of the standard, it can provide effective patent evaluation "weights and measures" for market entities, improve the patent asset management ability of innovation entities, and active patent operation transactions and investment and financing markets.

Let's take a look at the guidelines

(1) Early preparation for due diligence

The guidelines specify that before the analysis and evaluation of patent value, the type of patent, the technical field, the patent applicant or patentee and their changes, the approval stage of the patent, the annual fee payment, the termination of the patent right, the restoration of the patent right, the pledge of the patent right, whether it involves legal proceedings or is in the state of review, declaration of invalidation and other legal statuses should be reviewed. Analyze the correspondence between the technical scheme recorded in the patent claims and the products produced by the implementing enterprises, and make preparations for the early stage.

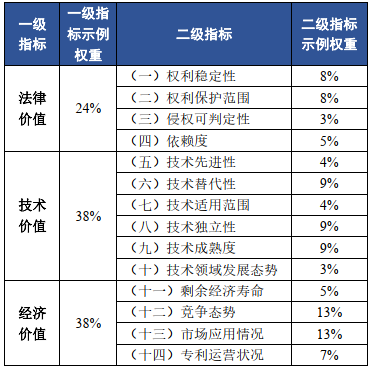

(2) Optimize the index system

The guidelines have optimized the evaluation indicators for patent value analysis by adding a number of extended indicators and establishing additional items in addition to the 27 core indicators. Among them, the core index refers to the necessity index that has an important impact on the value of the patent. The extension index is optional and can be selected according to the technical field and application scenario of the assessed patent. Additional indicators mainly include whether the patent is a major innovation achievement such as core technology research in key fields, whether it is a core patent that has control over the industry such as standard essential patents, and whether it has won national science and technology or patent awards and other indicators.

(3) Different application scenarios are involved

The application scenarios of patent evaluation specifically involve five categories: 1) license transfer, including patent license, patent transfer, patent investment, enterprise mergers and acquisitions; 2) Financial category, including patent pledge financing, patent securitization, etc.; 3) Financial reporting, including intellectual property transaction entry, merger consideration allocation, asset impairment testing, etc.; 4) Infringement remedies, including infringement compensation judgment, arbitration, etc.; 5) Management category, mainly related to patent classification management, of which high-value patent screening is a common situation.

The guide also shows in the form of examples how to use the analytic hierarchy process to adjust the weight of each indicator according to the mutual importance of each indicator. For example, in the case of patent transfer, according to expert experience, the weights of technical value and economic value should be appropriately increased. The weights of specific indicators are as follows:

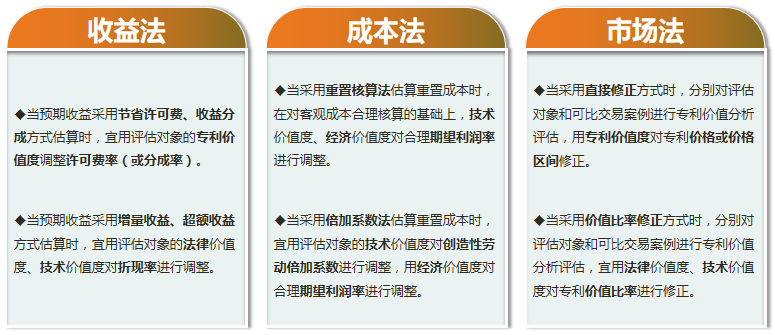

(4) Combined with asset evaluation methods

The patent value degree is used as the adjustment coefficient or parameter in the income method, the cost method and the market method, the three basic asset evaluation methods and their derivative methods. In the specific use, the correlation between the patent value analysis evaluation index and the asset evaluation factor should be considered, and the required indexes and factors should be reasonably selected to avoid repeated calculation. The details are shown in the following figure:

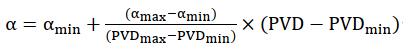

In practice, due to the particularity of patent, cost method and market method often lack applicable conditions, so it is common to use income method to evaluate assets. When the patent value degree is combined with the income method, there is a positive correlation between the license rate (or share rate) and the patent value degree. The formula for calculating the license rate (or share rate) is as follows:

α - The license rate (or share rate) of the assessed object

αmin- The lower limit of the licensing rate (or share rate) in the same field

αmax- The upper limit of the licensing rate (or share rate) for the same domain

PVDmin - The lower limit of patent value in the same field

PVDmax - The maximum value of patents in the same field

PVD- Evaluates the patent value of the object

About patent licensing rates

For the patent license fee a rate (or share rate) in the same field mentioned above, in 2021, the State Intellectual Property Office will implement the "Notice of the State Intellectual Property Office on Promoting and Regulating the Operation of intellectual Property Rights" on "Strengthening the information collection and statistical release of the record of patent transfer and patent license implementation contract". Official and public release of the "13th Five-Year" period of different national economic industry fields (involving categories and categories) patent licensing royalties and royalty rates and other statistical data, in order to provide basic data support for intellectual property evaluation and pricing, promote intellectual property transfer and transformation.

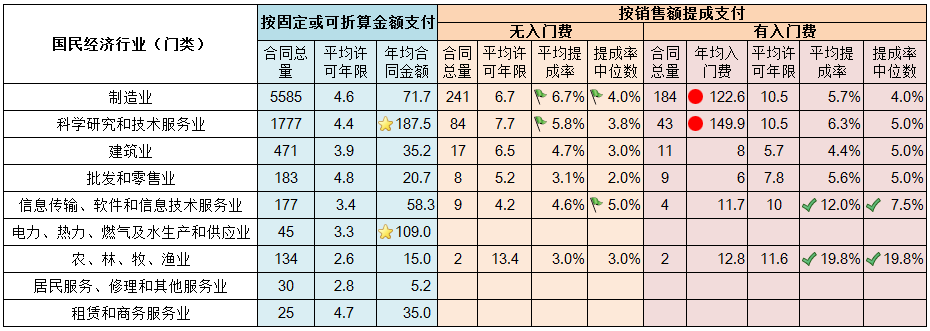

At present, the statistical cycle is 5 years, and the relevant statistical data for 2017-2021 has been released in 2022. The following table selects part of the data to mainly show the two types of patent licensing rates paid according to fixed or convertible amounts and paid according to sales commissions involved in key categories of national economic industries. Under each column in the table, the corresponding amount or the two industries with the highest commission rate are shown with different marks.

TAG

It is believed that in the future, with the implementation of more standards and norms such as the Patent Evaluation Guidelines, and the public release of operational data such as patent licensing, transfer and pledge in more industries, the patent evaluation mechanism will become more perfect, the evaluation results will be more reasonable and accurate, and the patent evaluation market will become more standardized, which will vigorously promote the orderly flow and efficient allocation of innovation resources. (Yuannuo Technology Transfer Center, author Fang Ting)

More intellectual property related issues, welcome your scan code consultation! Have questions must answer yo ~ Deep credible is willing to use professional and focus, to provide you with high-quality and efficient intellectual property agency services!

More information and services

The official subscription number of "Deep Trusted Intellectual Property Rights" on the code

More deeply trusted dynamic news, important data/reports, authorized cases, etc

Code on the concern [deep trusted intellectual property service platform] official service number

相关新闻

Telephone:

Telephone:+86-755-82566227、82566717、13751089600

Head Office:13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Head Office:

13 / F, Building 14, Longhua Science and Technology Innovation Center (Mission Hills), No. 8 Golf Avenue, Guanlan Street, Longhua District, Shenzhen

Subsidiary Company:2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Subsidiary Company:

2808, Block B2, Yuexiu Xinghui Junbo, No.18 Tazihu East Road, Jiangan District, Wuhan City, Hubei Province

Service Number

Subscription Number

Copyright ©2016 Shenzhen Shenkexin patent Agency Co., LTD All rights reserved | 粤ICP备2021174526号

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有 | 粤ICP备2021174526号 SEO标签

Copyright ©2016 深圳市深可信专利代理有限公司 版权所有